Fintech gamification: How to engage and retain users

Akshata Naik

09 Dec 2025

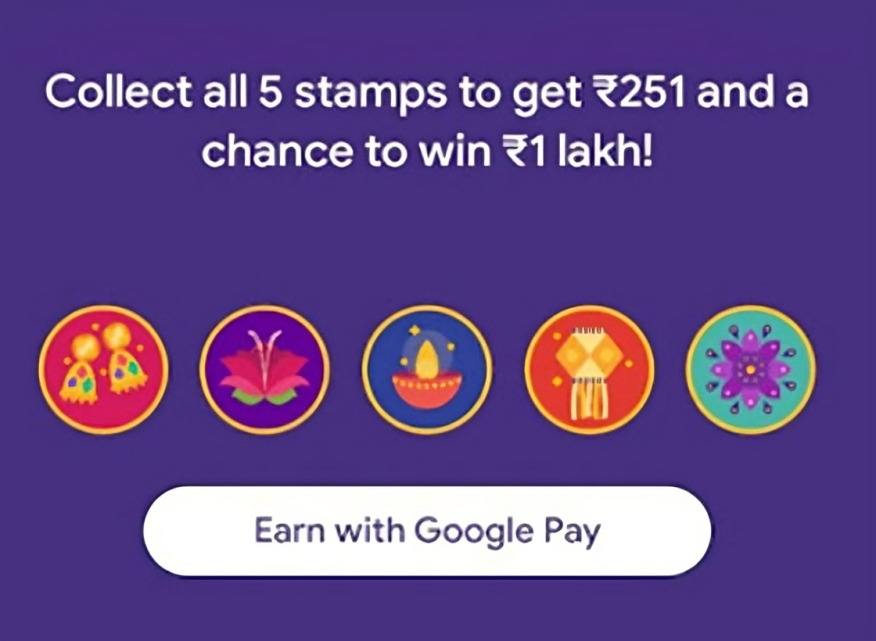

We've all been there, celebrating the completion of a rangoli on GPay, bragging about our Snapchat score, or treasuring all the coins earned on Cred.

Gamification is that exhilarating rush of excitement from every win in a situation that is anything but a game. It aims to not only capture users' attention but also keeps them engaged, by turning dull tasks into rewarding experiences. It encourages users to interact more frequently and for longer durations with your product. How?

Gamification leverages the natural human tendencies for competition, achievement, and collaboration into various activities and interfaces. Imagine harnessing this philosophy to make finance management gamified. Welcome to the wild world of gamification in fintech!

Fintech gamification is the hot new trend that's transforming the way we interact with our money - apps like GPay & Cred have excellently used gamification to keep users coming back for more.

Let’s uncover all the golden benefits of gamifying the fintech realm!

Increased user engagement

Gamification in fintech transforms the typically dull world of finances into a playground of fun and rewards. By integrating game elements like points, badges, and challenges, financial apps turn budgeting and saving into exciting quests. Every milestone feels like unlocking a new achievement in your favorite game; you’re earning rewards for making smart financial moves.

Ultimately, gamification makes managing money engaging and enjoyable. It’s not just about numbers anymore; it’s about the thrill of mastering your finances while having a bit of fun along the way.

Financial literacy

By turning complex financial concepts into interactive quizzes, challenges, and reward-based activities, fintech apps can simplify the learning process through gamification. Be it earning points for understanding interest rates or getting a badge for mastering the art of budgeting, gamification makes finances entertaining and educational at the same time.

Gamification enables users to gain valuable financial knowledge and become savvy money managers without even realizing it.

Customer retention

Money management apps like Qapital and Chime offer badges for hitting savings targets or completing financial education modules. These small incentives not only make the experience enjoyable but also keep users motivated to engage regularly. The integration of game-like elements often includes personal achievements and competitive aspects, which not only make financial management more engaging but also foster a deeper connection between the user and the platform. By continuously offering new goals and rewards, these apps keep users interested and invested, making them more likely to remain active and loyal over time.

Social interaction

Introducing gamification to the financial space can transform it into a vibrant social experience for users.When you open your banking app, picture yourself in a vibrant community where you can challenge friends to savings contests or celebrate your most recent financial milestones with emojis and virtual high fives. It’s like turning budgeting into a digital party!

Some apps like Zerodha Varsity and Groww feature leaderboards where users can see how they stack up against friends or even strangers in savings goals or investment returns. These friendly rivalries add a fun twist to financial planning.

And let's not forget the joy of showing off! When users achieve a new badge or hit a milestone, they can flaunt their success on social media channels, turning their financial victories into shareable moments. By encouraging social interaction through gamified features, fintech apps create a supportive environment where users can learn from each other and cheer on their financial progress.

Data collection and insights

Gamification in fintech is a clever way to gather valuable data. Each click, choice, and transaction made in this playful environment provides rich insights into user behavior and preferences.

For instance, when users race to complete savings goals or enthusiastically participate in budget challenges, fintech apps can analyze these interactions to understand what motivates users. This data helps companies tailor offerings, improve user experience, and develop new features that hit the mark.

By turning financial tasks into engaging activities, fintech companies gain tons of information to enhance their services. So, while users enjoy the gamified experience, fintech firms get smarter about their needs and habits.

In conclusion, gamification in fintech offers a transformative approach to financial services, enhancing user engagement and retention through interactive elements. By making financial tasks enjoyable and rewarding, these strategies promote financial literacy, encourage positive behavioral changes, and foster social interaction among users.

Moreover, gamification provides valuable insights into user behavior and preferences, enabling fintech companies to refine their offerings and better meet the needs of their audience. Ultimately, this approach not only improves the overall user experience but also cultivates a loyal and informed user base, positioning gamified fintech platforms as innovative leaders in the financial technology landscape.

We hope this blog helps you in creating very interesting gamified interfaces for your users. Ready to elevate your designs and enhance your digital presence? At Lemon Yellow, we specialize in crafting delightful user experiences that leave a lasting impact. Let’s create something amazing together, contact us today!