The Ethics of AI in Fintech: Balancing Innovation with User Privacy

Akshata Naik

Have you ever come across words that seem to bore you just by looking at them? Terms like budgeting, expense tracking, trading, and credit score often have this effect. Despite the evolution of financial services into user-friendly fintech apps, making these tasks more manageable, they can still be tedious and challenging for many. Here is where our favorite frenemy comes into picture, Artificial Intelligence (AI).

The fintech landscape is undergoing a revolution driven by artificial intelligence (AI). AI algorithms are rapidly transforming how we interact with our finances, from automating mundane tasks like expense categorization to providing sophisticated fraud detection and risk management solutions. Even complex financial instruments and services are becoming more accessible through AI-powered chatbots and virtual assistants that can answer our questions, guide us through financial decisions, and even help us manage our investments. Now you won't have to worry about your relatives nagging you to learn finances—AI has got your back!

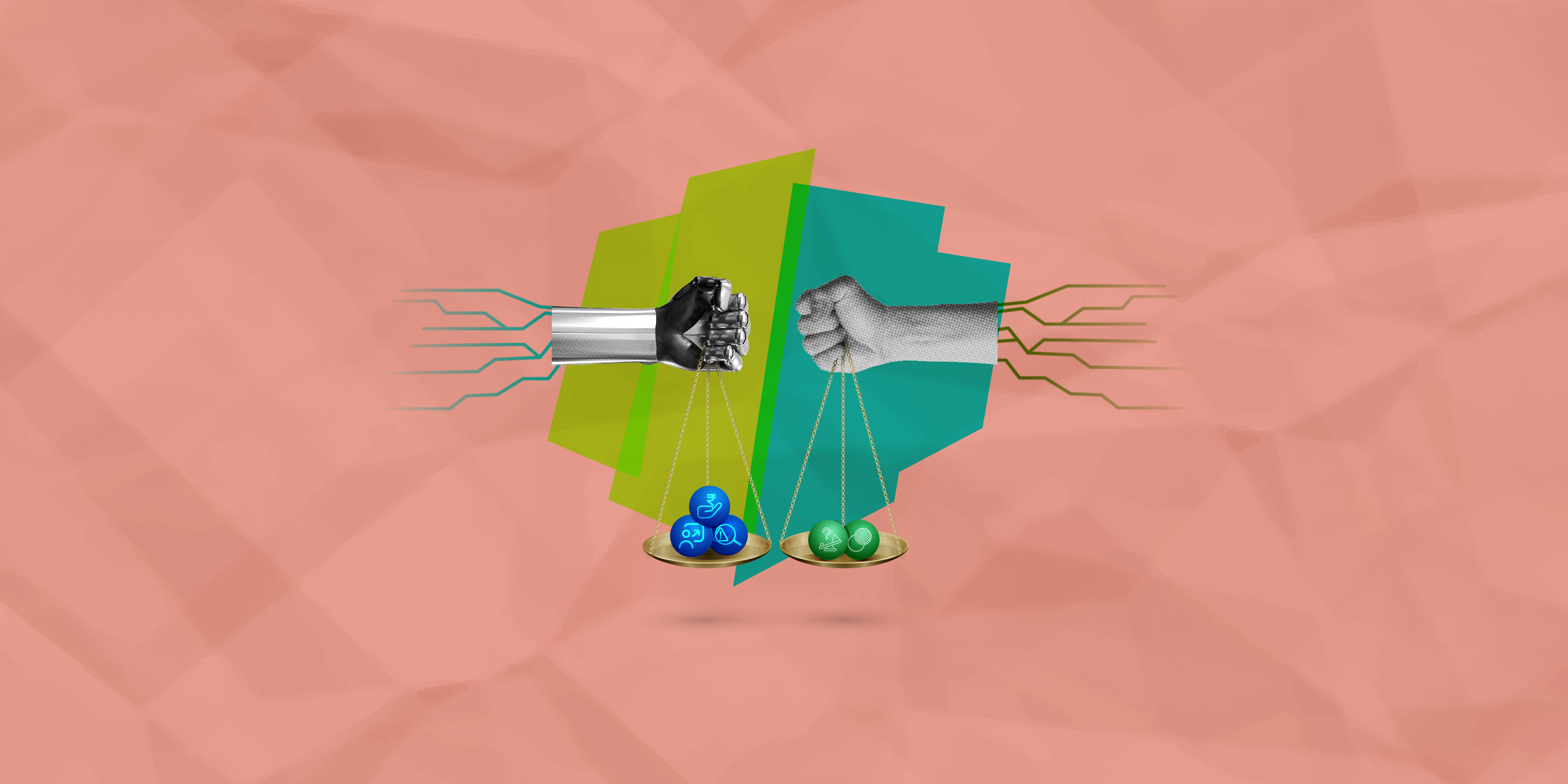

While AI promises to revolutionize financial services by enhancing efficiency and personalization, its integration raises critical ethical considerations that must be addressed to ensure user safety and trust (we called it frenemy for a reason). Let’s do the favorite thing the internet has been doing with AI: pros & cons!

Pros of AI in Fintech

-

Fraud detection

Imagine you're using your bank app to buy movie tickets on a Saturday night. Usually, you get tickets at the same theater every few weeks. But this time, you're at a new cinema across town. This is where AI swoops in like a digital Sherlock Holmes to identify potential fraud. Fintech AI analyzes your spending patterns, considering factors like average purchase amounts, locations, and even the time of day you make transactions. So, when you buy tickets from a new place on a night you typically stay in with a pizza, AI raises an eyebrow.

Your transaction might be flagged for review due to this anomaly. This is just one example of how AI can sift through mountains of data to spot shady activities instantly and keep your money safe. Sherlock would be proud!

-

Behavior-based solutions

In simple terms, AI in fintech acts like a smart financial buddy, learning your habits to offer tailored advice and tools to keep your finances on track. Imagine you use a budgeting app that tracks your spending. This app uses AI to analyze your purchases and income. Based on your behavior, AI can offer personalized solutions.

For example, if you splurge more on weekends, the AI might cheekily suggest setting aside some "fun money" each week. Or, if your checking account is gathering more dust than interest, AI might nudge you towards a savings account with a higher rate to make your money work harder. It's like having a financial advisor who knows you a little too well but in the best possible way!

-

Financial forecast

AI crunches massive amounts of data, like past stock prices, news articles, and even social media gossip. By analyzing these patterns, AI can forecast future market movements, much like a weather forecast predicts sunny or rainy days. For instance, if AI spots a surge in positive news and online chatter about a particular company, it might predict a rise in its stock price.

This information can help both financial institutions and individuals make informed decisions. However, remember that AI forecasts are like a friend's advice—they're not guarantees, just educated guesses based on what it's been told.

Cons of AI in Fintech

-

Lack of transparency

The rise of AI-powered applications in fintech is like giving your financial tools a turbo boost, offering faster processing and super-targeted products. But here's the catch: unlike traditional loan officers who might explain their decisions based on income or credit score, AI models are basically black boxes. They sift through mountains of data to make decisions, but the exact reasons behind those decisions are as mysterious as the recipe of Coca-Cola.

This lack of transparency can be a real headache for both lenders and borrowers. Imagine applying for a loan with a stellar financial profile, only to be rejected without a clue as to why. This opacity can break the trust and make folks wonder if AI is playing favorites or just having a bad day.

To make sure AI in fintech stays on the straight and narrow, we need to work on the explainability and transparency of these algorithms. It's time to lift the veil and let everyone see what's really going on behind the digital curtain.

-

Learning bias

Imagine you're creating a playlist for a friend based only on the music you listen to. They'll get a great taste of your favorites, but it won't reflect all genres. Now imagine an AI system approving loans in fintech. It might only approve loans for people who seem "financially responsible" based on past data. The problem? That past data might reflect historical biases. If people of a certain background were denied loans in the past, the AI might see them as risky even if they're qualified today. This is bias in AI - it learns from data that isn't always fair and can lead to unfair decisions about things like loans or investments.

In conclusion, navigating the ethical landscape of AI in fintech is like taming a digital beast. It's crucial to address biases, unveil the mystery of black-box algorithms, and fortify our defenses against data breaches. By promoting diverse datasets, explainable AI, and strong regulatory frameworks, we can harness the immense potential of AI without letting the ethical clowns trip us up.

The future of fintech can be both innovative and fair—like having your cake and eating it too—without the AI secretly judging your calorie intake. Let's ensure that as we leap into this brave new world, we do so with eyes wide open and ethics firmly in place.