RXIL

Redesigning for RXIL, the catalyst in MSME’s growth

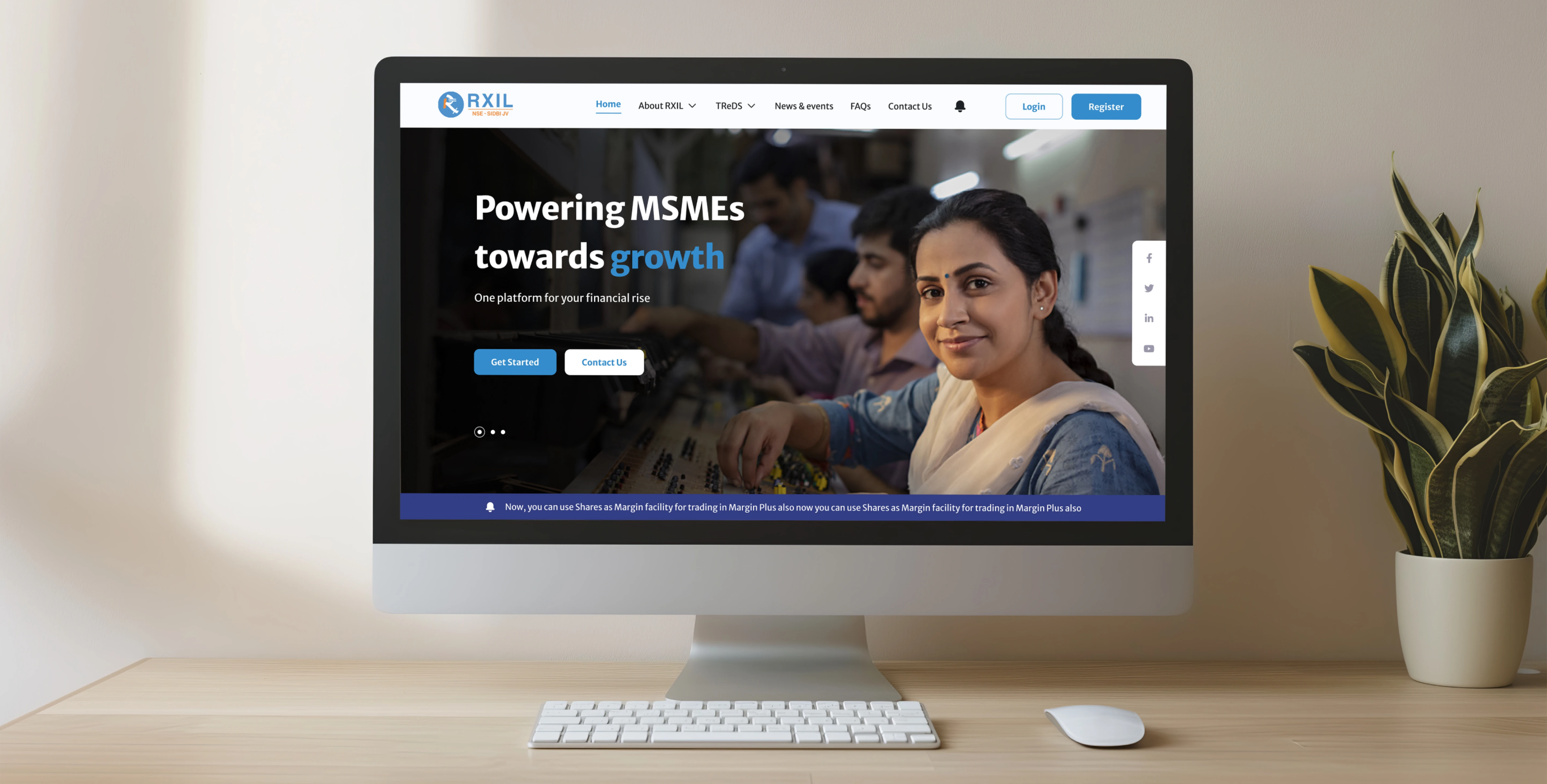

Transformed the Indian MSME landscape of Invoice Discounting, by shaping RXIL’s redesigned website.

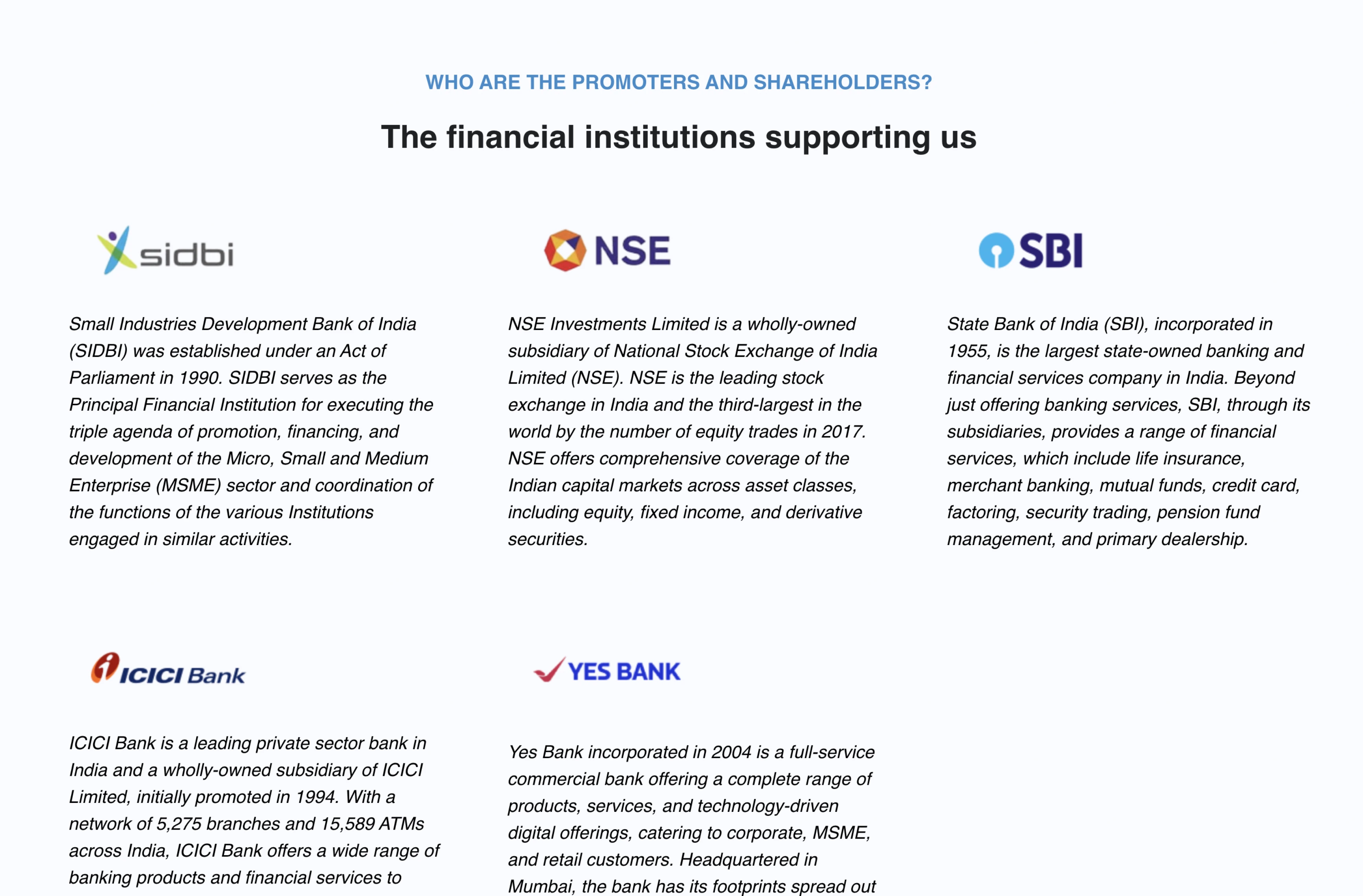

RXIL (Receivable Exchanges of India Limited) is a joint venture between SIDBI (Small Industries Development Bank of India) and NSE (National Stock Exchange). RXIL serves as India's first TReDS (Trade Receivables electronic Discounting System), which aims to provide MSMEs (Micro, Small & Medium Enterprises) with timely access to working capital by facilitating the discounting of their trade receivables.

Powered by design thinking and fruitful brainstorming sessions, we revamped the user experience and built a platform for seamless collaboration between buyers, sellers, and financers.

Challenge

The MSME sector acts the backbone of the Indian economy. But it faces significant challenges, primarily related to access to finance. A leading institution that facilitates lending, is RXIL. The main challenge was to redesign RXIL’s website, by giving it a look and feel that puts the brand’s offerings forward in a clear, concise manner.

Industry

FinTechServices

UI UX design Motion graphic design Full-stack developmentCreative Quotient

Design lead UI/UX designers Motion graphic designer Developers

Our approach

The partnership between RXIL and Lemon Yellow yielded a simple yet impactful design that accurately depicts the brand's identity and industry positioning. Our primary goal was to highlight RXIL's accomplishments, and the potential of the TReDS platform, and therefore, creating a digital experience that underlines their leadership in the MSME industry.

The Lemonade Process

Adding a reliable zest to the process

- Research

- Requirement gathering

- Our understanding

- Competition analysis

- Plan

- User flows

- Information architecture

- Explore

- Wireframes

- Moodboarding

- Create

- UI UX design

- Animation

- Web development

- Delight

- Prototyping

- Micro-interactions

- Analyze

- User testing

- Quality analysis

Understanding the users

These users are the micro, small and medium enterprises that supply goods or services to corporations and businesses. MSMEs look for funds to continue smooth functioning of their business.

This user category includes large corporations and businesses that require certain goods or services offered by smaller businesses. For the same, businesses initiate transactions and raise invoices.

This user category includes banks and non-bank financial companies/institutions (NBFCs/NBFIs). These banks/NBFCs facilitate smooth lending between both the parties involved - MSMEs and corporations.

Outdated design. Lacked consistency in communication.

Started from scratch, built a website with improved messaging. Added a more relatable look and feel to it.

Facilitating capital like never before

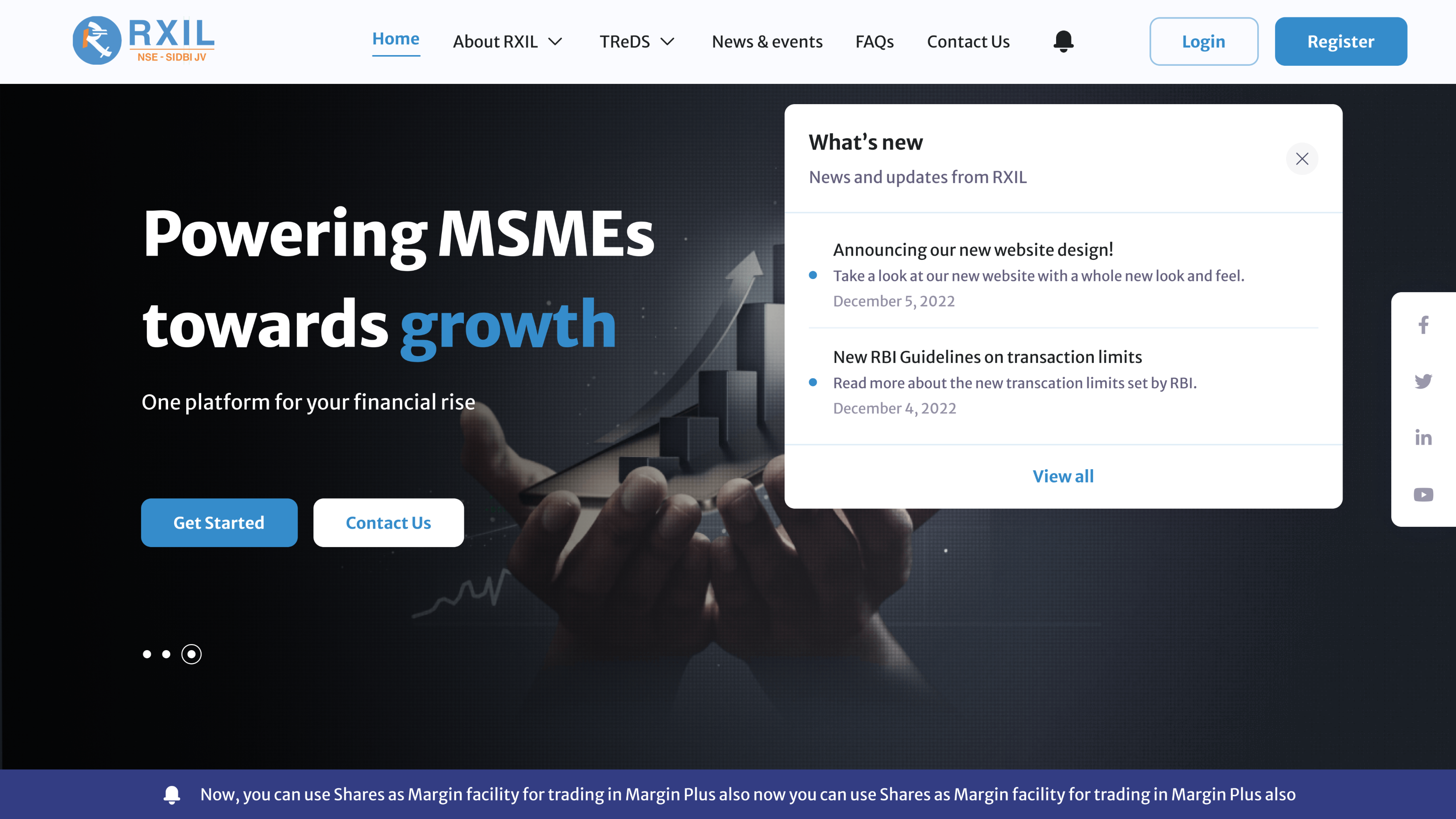

The brand wanted to showcase their extensive work portfolio, and improve the website’s overall navigation and accessibility for users. We designed a notification panel that helped users get regular updates regarding policies and any new changes. Contacting RXIL was made much simpler too, which helped extend the brand’s credibility.

Solutions that simplify processes

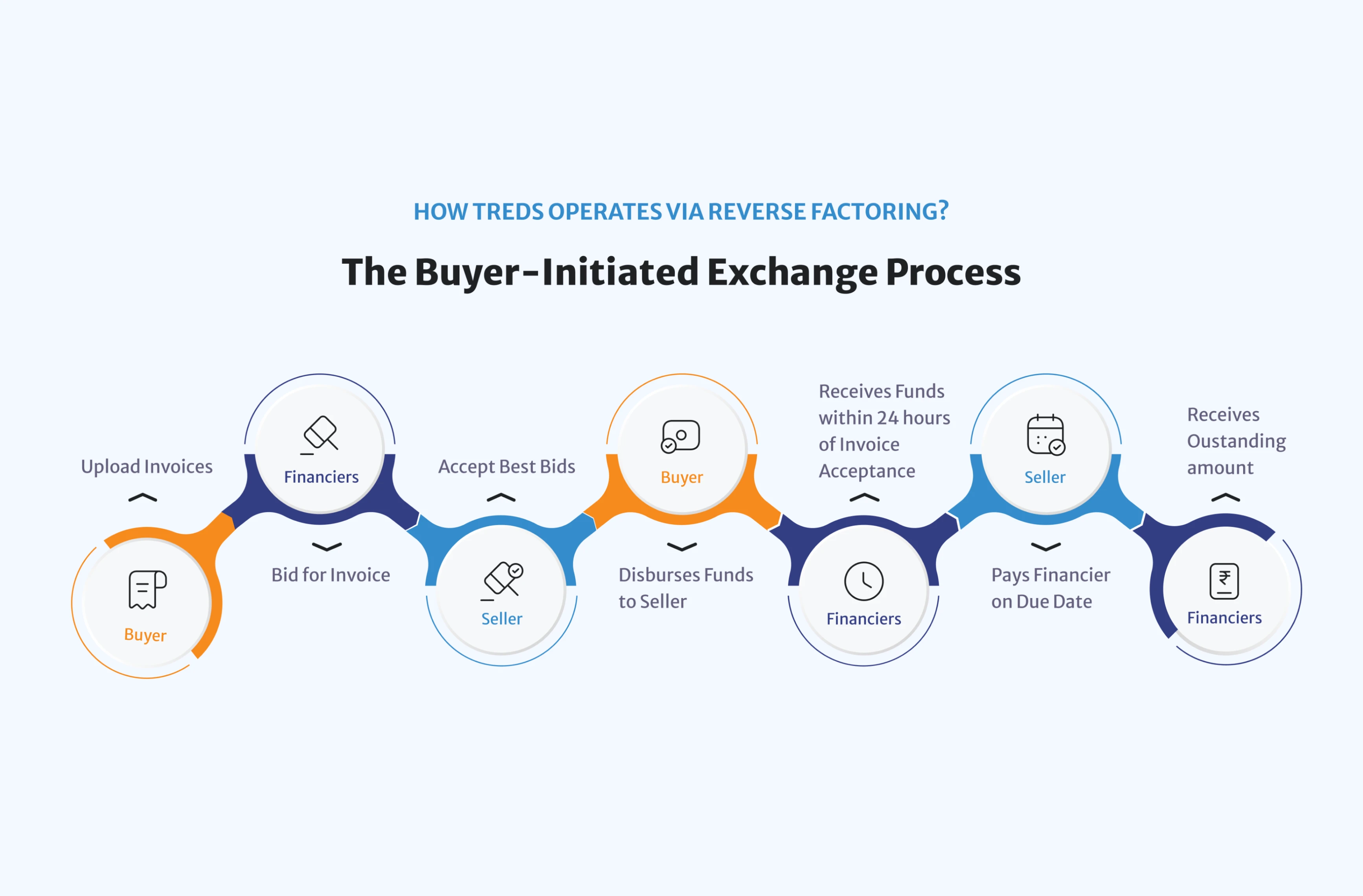

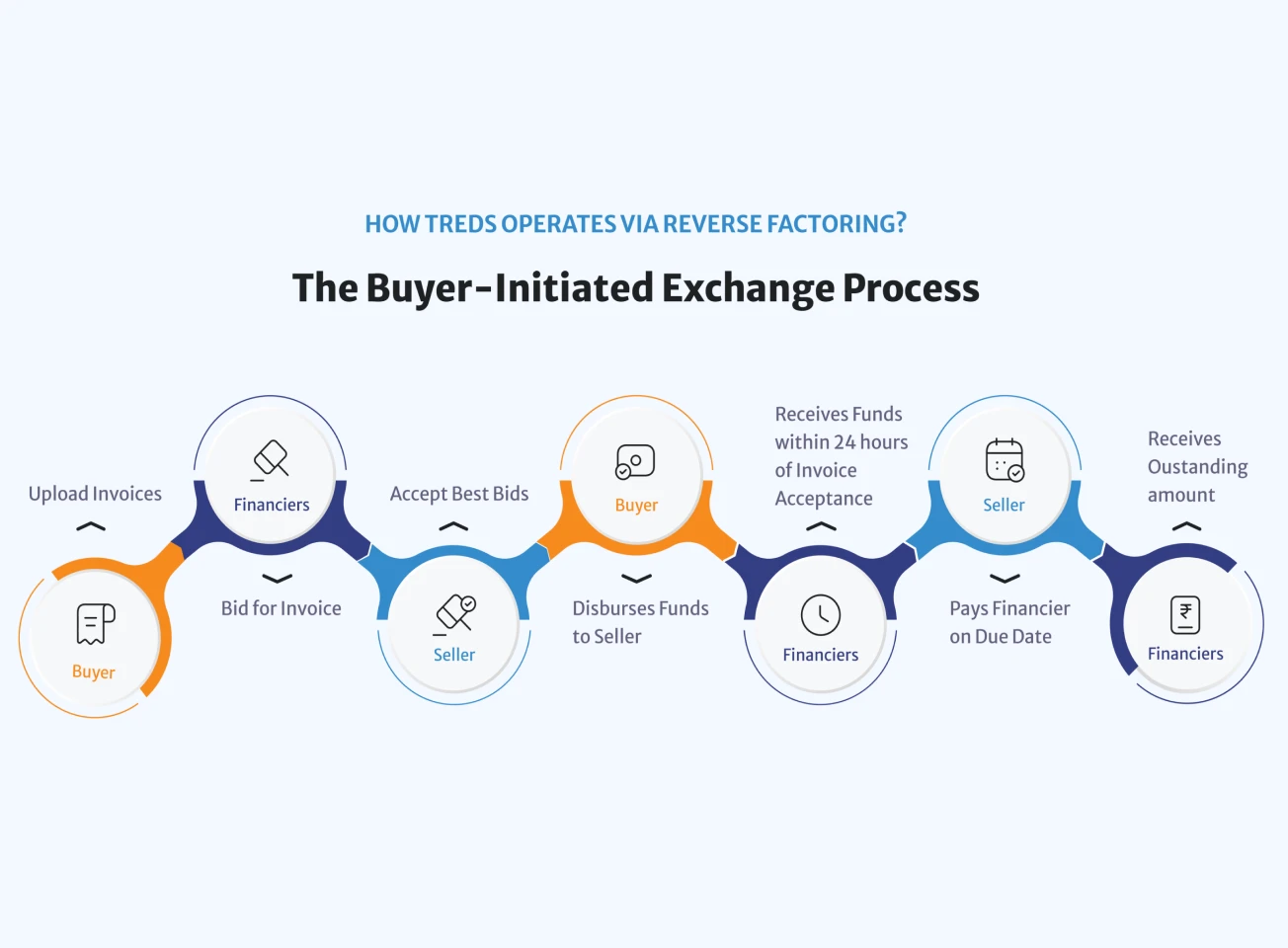

Complex processes were simplified with design solutions. The factoring (shown below) depicts how the exchange process operates from start to end. For old and new visitors alike, such a simpler, clearer process makes the task a whole lot easier to complete. An accentuated factoring process made the required difference for this leading TReDS platform in India.

Enhancing the experience with code

Using Hypertext Processor (PHP), we custom-built UI components to maintain design integrity. We implemented subtle animations and Lottie integrations to enhance the user engagement and make the website visually engaging without compromising its speed or efficiency. We also enabled effortless content management by providing RXIL with custom functionalities. From adding new blogs to delivering real-time notifications, we ensured that the process remained flexible, smooth, and intuitive.

The result

Lemon Yellow’s collaboration with RXIL, one of India's leading financing platform in the MSME sector, resulted in an evolved user experience. By conveying information effectively and making the platform more user-centric, the new website resulted in improved performance and engagement - always a delight! 🎉