Kotak Current Account

Digitizing the process of opening a current account

Created a quick & seamless current account opening experience for users of Kotak Mahindra Bank.

Kotak Mahindra Bank is a well marked private sector bank in India. It offers a wide range of banking products and financial services in the areas of personal finance, life insurance,

investment banking and wealth management. Moreover, Kotak has been the industry leader in creating do it yourself (DIY) journeys for savings account creation. A journey the bank now wanted

to build for current account opening.

Driven by design thinking, we redefined the user flow to achieve the smooth journey users will take while opening a current account.

Challenge

The existing current account opening journey called for a digital revamp, such that the process can be carried out by the applicants themselves. We aimed to compartmentalize the form to make it quick and easy to understand, effectively bringing the form filling time down.

Industry

FinTechServices

UI UX design UX writing Web developmentCreative Quotient

Design lead UI/UX designers UX writer Frontend developers

Our approach

The focal points of this collaboration were the users, and what Kotak Mahindra Bank stands for, as an institution. We worked towards designing an experience that the users would find intuitive and easy to understand. Our approach, thus, was to improve the existing flow of user journeys and not reinvent the wheel completely. This would help make the user journey a lot more convenient to follow, keeping the user at ease.

The Lemonade Process

Added our touch of making money simple

- Research

- Competition analysis

- Plan

- Stakeholders interview

- User interview

- Information architecture

- Explore

- Design workshop

- Wireframes

- Moodboarding

- Create

- UI UX design

- Design system

- Delight

- Prototypes

- Micro-interactions

- Analyze

- Quality analysis

Understanding the users

These are the users with enterprises of their own, such that there is no legal distinction between the owner and the business entity. They use current accounts to exercise digital billing, business promotion, and more.

This category of users include individuals who are whole and sole owners of the account. Only the individual owners can operate the account to carry out daily transactions and other services.

These users own a private limited (Pvt. Ltd.) company. The ownership of the company is shared with a maximum of 50 shareholders. The account, too, has shared ownership of

<50 users, to

carry out various tasks.

These are the users who own shares in a public limited company (PLC). There is shared ownership between all the major shareholders of the company, who can access and use the account.

Lengthy and complicated form. Not DIY-friendly. Increased complexity.

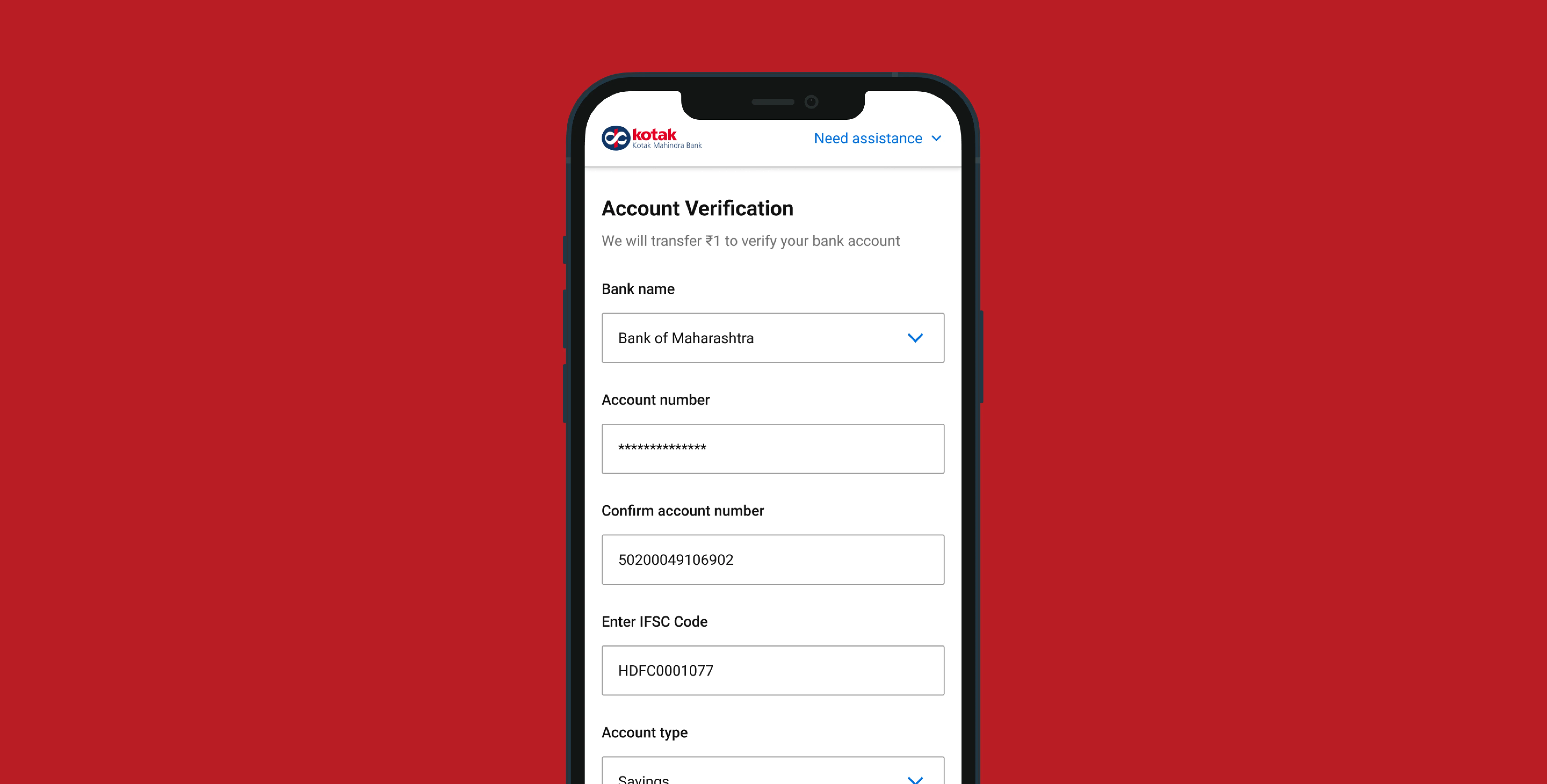

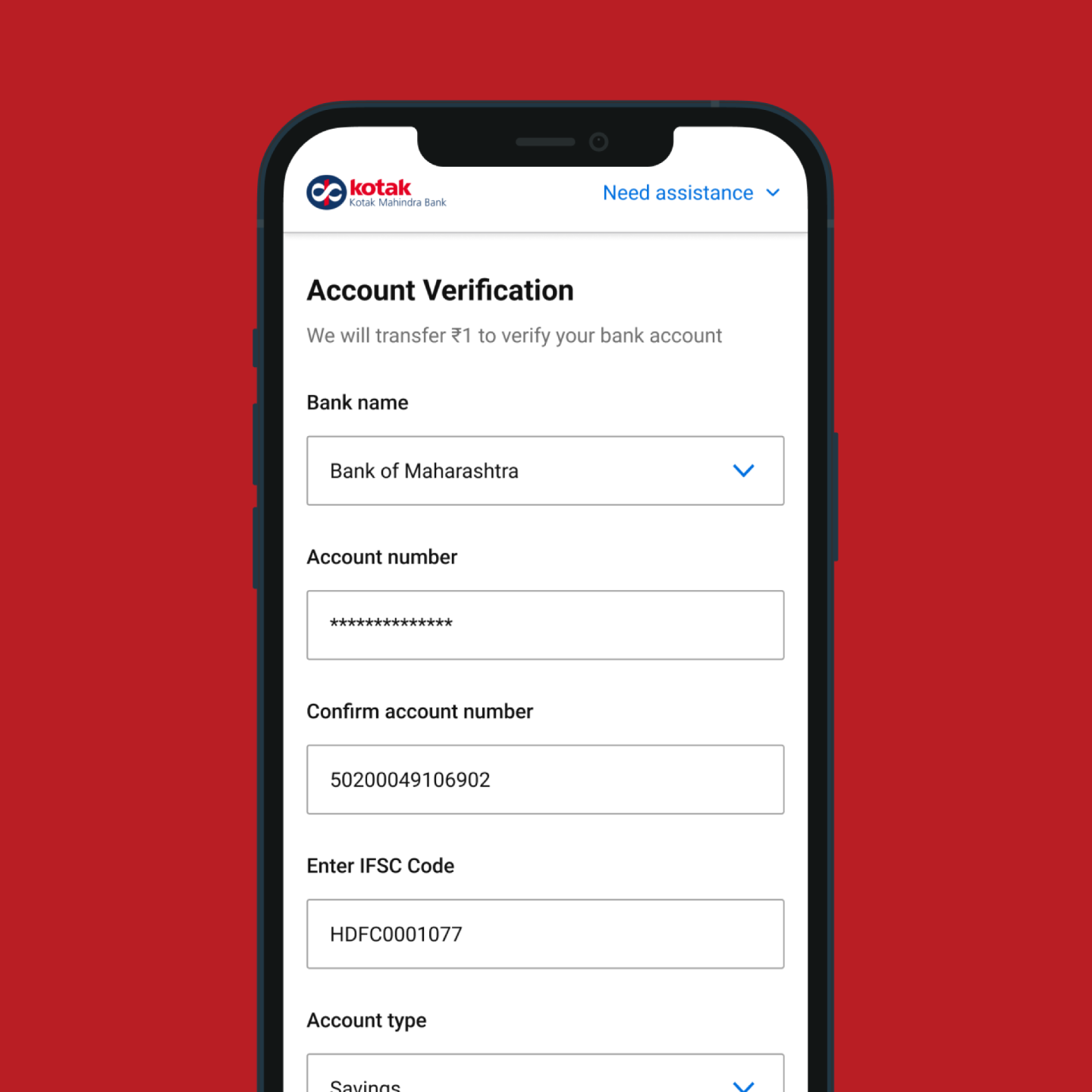

Designed a pre-read for the users. Simplified the form with step-wise pages, and the option to save, close, and resume anytime.

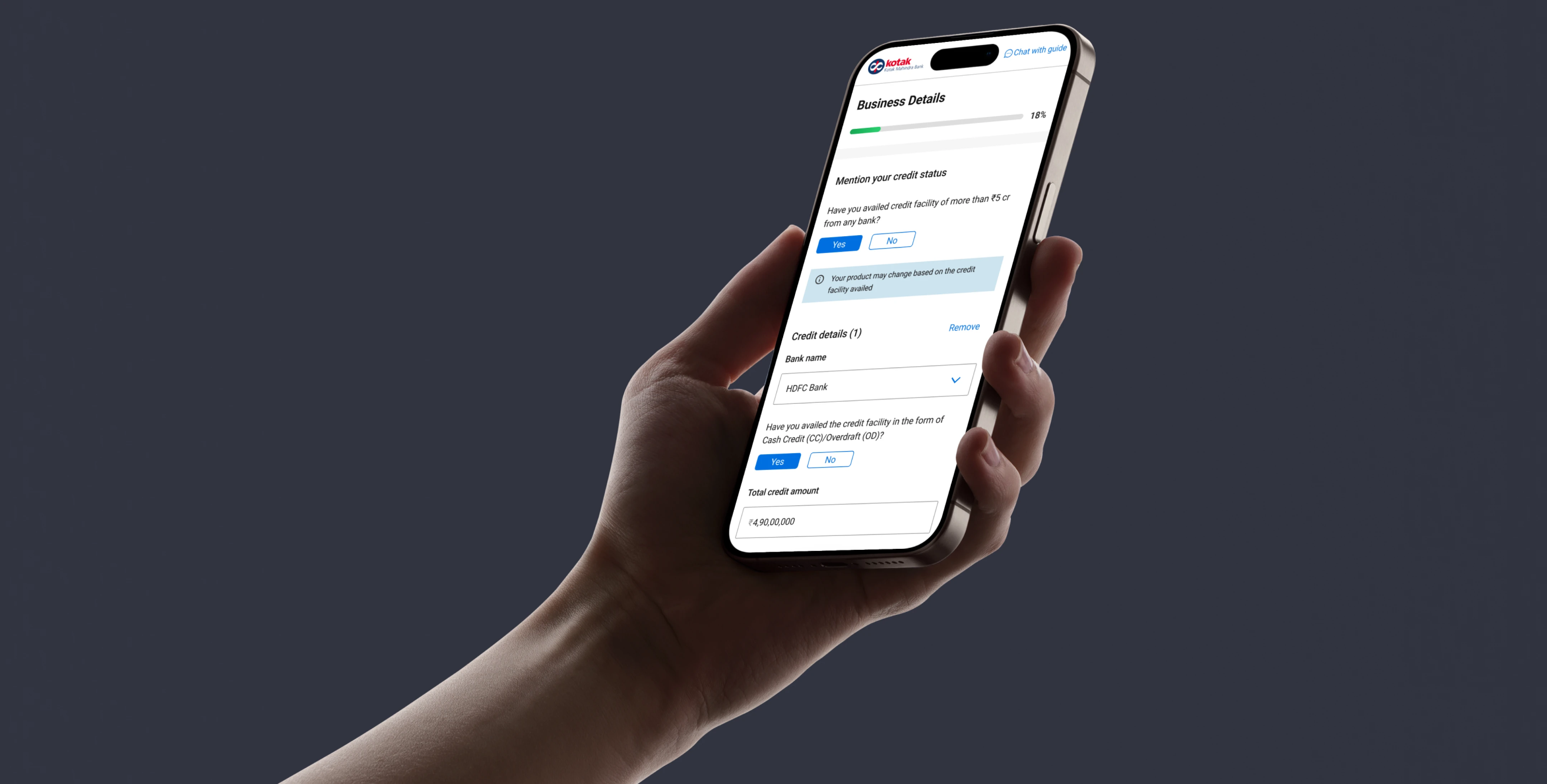

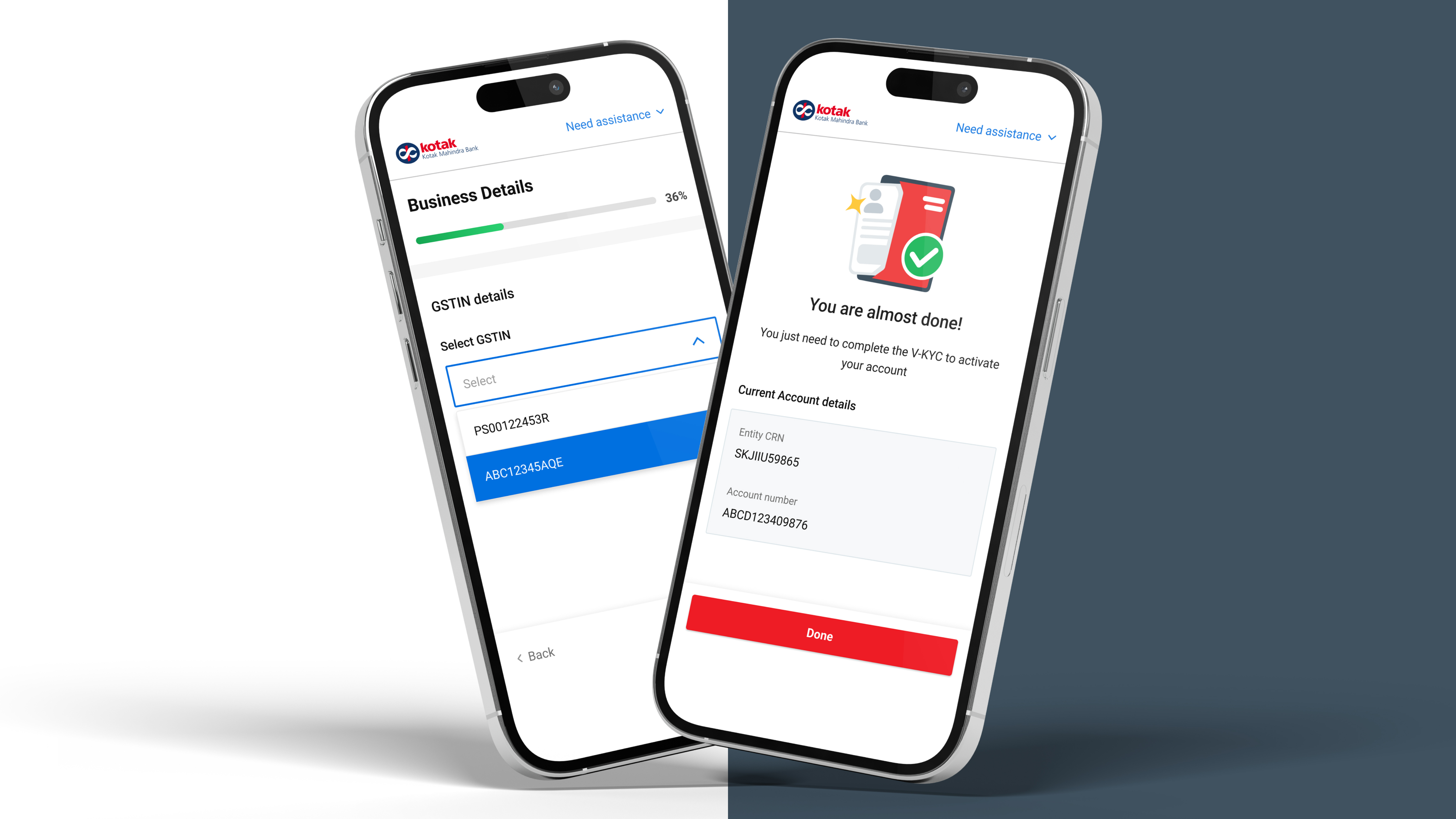

Money made simple

Bringing the brand’s “Make Money Simple” vision forward, we made the account opening journey simple too. The users are ensured proper guidance with right instructions, every step of the way. Breaking down multiple actions into smaller steps makes the process more efficient for users to take. Overall navigation of the form is made easier too, with saved progress which allows users to pick up right where they left off.

Process made simple

Gone are the days when users had to visit the nearest bank branch and get in a queue to open an account. Thanks to fintech innovations, it can now be done just as easily from one’s couch. The process is quite intuitive and easy for the users to understand, making the do it yourself (DIY) journey a great success.

Technicalities - also made simple!

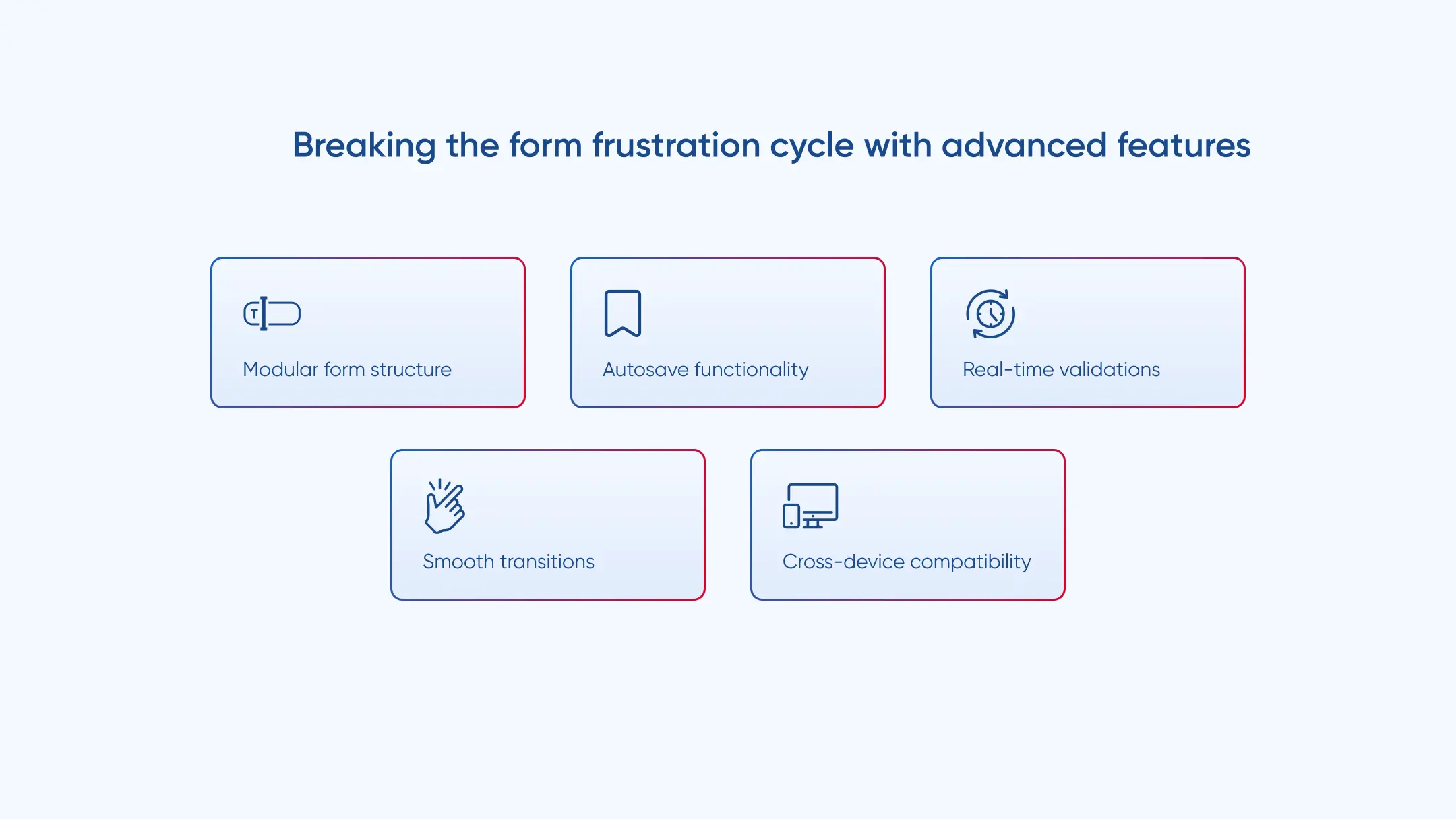

As we moved on to development, we built a modular form structure where form fields adjust dynamically based on user input. This ensured that the users see only the fields relevant to them, thereby reducing any friction or confusion. We implemented an autosave functionality, allowing users to leave and return without losing progress, real-time field validations to prevent errors, as well as smooth transitions between the form steps. Finally, the platform was engineered to be compatible across various devices, for a seamless experience on each.

The result

Our collaboration made Kotak Mahindra Bank’s current account opening process completely digital, and marked the brand’s progress towards digital revolution. We made money simple by designing digital happiness: a fulfilling partnership of its own! 🎉